Foreword by Eda Özden, Managing Director, MEP DMC

“We are very encouraged by this second set of results that the Index yielded. The fact that so many companies remain so committed to incentive travel shows the inspirational power of travel. However, as expected, risk aversion will become an even bigger topic for all stakeholders. We remain confident in MEP’s and Turkey’s ability and agility when facing risk and are proud that our destination can flourish in this changing environment.”

North American and European Buyer Predictions for a Post-Covid Future

Now in its third year, the annual ITII (Incentive Travel Industry Index) is fast becoming an indispensable report on the state of incentive travel, providing stakeholders with empirical data on its current and future evolution. This year’s findings are timely and meaningful as the industry prepares to recover anew in a post-COVID future.

In this section of the report we examine how quickly North American and European markets expect incentives travel to recover in a Post-Covid future. Will the positive proactive approach the North American market had on its business outlook roll into predictions specifically related to incentive travel? Do the European buyers maintain their more cautious approach?

Commitment to Incentive Travel

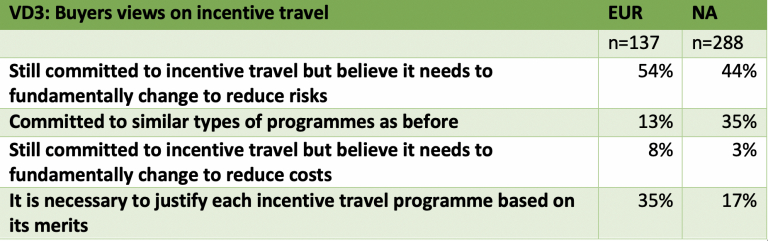

We look at each of the markets overall commitment to the incentive industry moving forward and whether they believe the incentive market will return to the same levels as before, utilising similar programmes as before – or if the whole industry be fundamentally different in a PostCovid world.

Overall both markets show there is still commitment to the incentive industry as a whole – however 62% of European buyers believe that it needs to fundamentally change to reduce risks (54%) and to reduce costs (8%), while only 47% of North American buyers believe this. There is a much higher emphasis on risk reduction rather than on cost reduction which is no surprise, as companies need to show incentives are safe, before they even look at the costing side.

35% of North American buyers say they are committed to carrying out programmes similar to before, compared with only 13% of European Buyers. Here again we see the more positive viewpoint of the North American market, relative to a more realist or cautious approach of their European counterparts. 35% of European buyers also believe that each individual incentive travel program will need to be justified before any sign off, whilst this is only the case for 17% of North Americans buyers. Again this shows a more guarded approach from the European buyers when compared with North American buyers.

Incentive Travel Recovery

European buyers’ cautious approach can also be seen when we look at how the different markets predict recovery timelines.

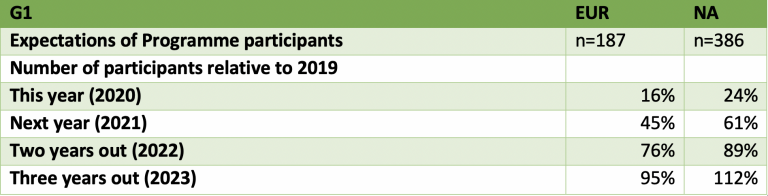

Utilising 2019 as a benchmark, ITII asked buyers to predict when they expected the number of programme participants to return to 2019 levels (or above). 100% represents 2019 levels, whilst anything below 100% represents decreased numbers and anything over 100% represents higher participant numbers.

In 2020, both European and north American buyers foresee massive reductions (16% vs 24% respectively). With only 3 months (Jan, Feb, March) of incentives in 2020, and in the lower season, it is no surprise that both markets expected final participant numbers for 2020 to be below even a quarter of 2019.

However, what is really interesting is the different recovery times each of the markets predict. While 2021 is still expected to be a very quiet year, North American buyers still predict 61% of 2019 numbers, compared to European buyers at 45%. This can be seen again in 2022 when, while number rise, North American buyers remain more positive overall, so much so that by 2023, not only do they predict the incentive market will have recovered, but that it will be even better than 2019. Compare that to the European buyers, who do not predict a full recovery until at least 2024.

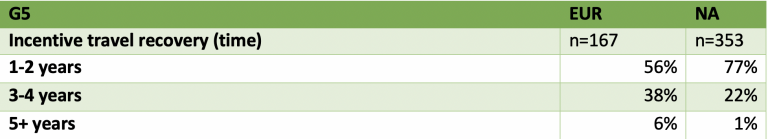

77% of North American buyers foresee a full recovery in 1-2 years versus only 56% of European buyers overall. Again, this shows the big differences between the two different markets – European Buyers are using a more cautious, reactive approach while North American buyers have a more positive, proactive approach. Deciphering which market will be correct in the long run is hard!

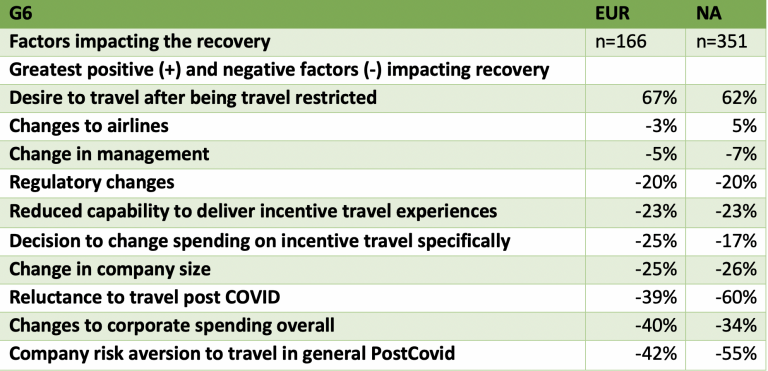

When it comes to factors which impact the recovery of incentive travel, both markets are aligned. Desire to travel after being travel restricted for so long serves as the biggest positive factor impacting recovery with 67% of European buyers and 62% of North Americans choosing this option. After that, however there are much more negative factors noted, such as company risk aversion to travel, changes to corporate spending overall and reluctance to travel, all contributing to a slower recovery.

Role of the DMC

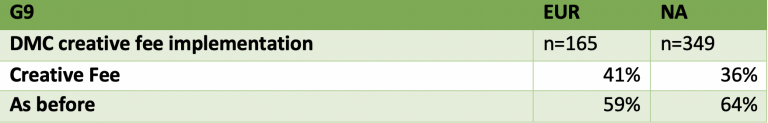

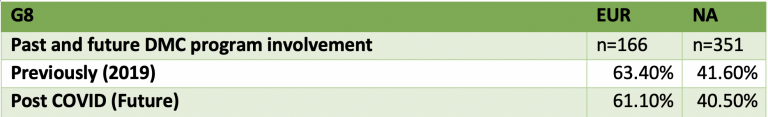

When it comes to the role a DMC plays in a programme, buyers do not foresee much change. This is somewhat surprising as one could have predicted an increase in reliance on a good DMC at local level to ensure safety and risk management throughout. However, this is not the case, with DMCs being expected to be used at the same levels pre and post Covid.

However, there may be a shift in how DMCs market their offerings with 41% of European Buyers and 36% of North American buyers predicting a shift towards a more creative fee based model as opposed to the previous models PostCovid.